By From OECD publications

Read Online or Download The Financial Crisis. Reform and Exit Strategies Book PDF

Similar economic policy books

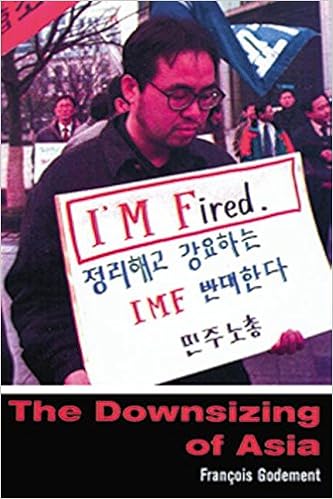

Until eventually very lately it used to be assumed that the Asian miracle of prodigious monetary progress could proceed indefinitely. Europe and the United States, it appeared, have been being left at the back of. the hot monetary concern in Asia has now replaced all that. Fran? ois Godement offers a broad-ranging survey of the areas economies on the grounds that 1993 and explains the most purposes at the back of the hot monetary drawback.

Economic Analysis & Canadian Policy

Monetary research & Canadian coverage: 7th variation offers with ideas and theories in economics and its relation to Canadian monetary guidelines. the key revision during this variation bargains with the advance of the true region version for the macroeconomy. The booklet is split into components. half I is a common evaluate of economics and comprises issues akin to uncomplicated fiscal judgements, monetary rules and research, offer and insist, marketplace fee, and the position of the govt. within the financial system.

- The Power of Everyday Politics: How Vietnamese Peasants Transformed National Policy

- Constituent Interests and U.S. Trade Policies (Studies in International Economics)

- Principles of Economics for a Post-Meltdown World

- Competition Policy Analysis: An Integrated Approach

- Creating Silicon Valley in Europe: public policy towards new technology industries

- Distributist Perspectives: Volume I

Additional info for The Financial Crisis. Reform and Exit Strategies Book

Example text

For investors in private equity and hedge funds carrying out active management of businesses they have purchased onshore, this provided access to passive income without any tax complications arising from business activity. In particular, non-US and tax-exempt US private equity and hedge fund investors avoided the need to file returns or pay tax on a share of “effectively connected income” or “unrelated business taxable income” that the partnership structure of US based SPVs would have required.

Strengthen disclosure and information processing by markets A central role of financial markets is the processing of information to mobilize saving and allocate it toward investment opportunities as efficiently as possible. Since obtaining and processing information can be expensive, mechanisms that do this transparently and economically should be encouraged and even supported by public policy. Disclosure, wide dissemination and accurate processing of information should have the highest priority.

This was recognized by the Financial Services Authority (FSA) in the United Kingdom as equivalent to other internationally recognized supervisors, providing supervision similar, although hardly identical, to Federal Reserve oversight of bank holding companies. 5 Furthermore, even if the SEC had been well-equipped to carry out supervisory responsibilities beyond the activities of broker-dealer subsidiaries, the scope for different approaches to enforcement noted by the GAO would have remained as a potential distortion to competition.